Six things that could get more expensive for Americans under Trump tariffs

Business reporter, BBC News

US President Donald Trump has imposed a range of tariffs – or import taxes – on billions of dollars worth of goods coming into the US from some of its top trading partners.

The tariffs apply to steel and aluminium imported to the US, as well as to some other products from Mexico, Canada and China – prompting counter-measures from the latter two countries and the European Union.

Economists have warned the US tariffs – and those introduced in response by other countries – could put prices up for American consumers.

That’s because the tax is paid by the domestic company importing the goods, which may choose to pass the cost on to customers, or to reduce imports, meaning fewer products are available.

So which things could become more expensive?

Cars

Some cars are among the products given a temporary reprieve by Trump from a new 25% import tax imposed on Canada and Mexico.

When this ends, cars are expected to go up in price – by about $3,000 (£2,300) according to TD Economics.

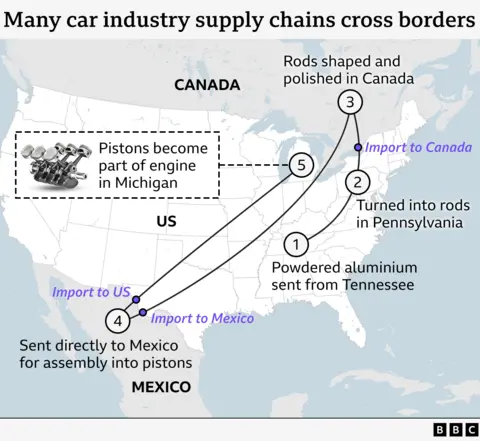

That’s because parts cross the US, Canadian and Mexican borders multiple times before a vehicle is assembled.

Many well-known car brands, including Audi, BMW, Ford, General Motors and Honda trade parts and vehicles across the three countries.

The cost of the higher taxes due on imported components is likely to be passed on to customers.

“Suffice it to say that disrupting these trends through tariffs… would come with significant costs,” said TD Economics’ Andrew Foran.

He argued that the “uninterrupted free trade” which has “existed for decades” in the car-making sector has lowered prices for consumers.

Beer, whisky and tequila

Getty Images

Getty ImagesPopular Mexican beers Modelo and Corona could get more expensive for US customers if the American companies importing them pass on the increased import taxes.

However, it’s also possible that firms could decide to bring in less foreign beer.

Modelo became the number one beer brand in the US in 2023, and remains in the top spot, for now.

The picture is more complicated when it comes to spirits, which have been largely free of tariffs since the 1990s.

Industry bodies from the US, Canada and Mexico issued a joint statement in advance of the tariffs being announced saying they were “deeply concerned”.

They argue that certain brands, such as Bourbon, Tennessee whiskey, tequila and Canadian whisky are “recognized as distinctive products and can only be produced in their designated countries”.

So given the production of these drinks cannot simply be moved, supplies might be impacted, leading to price rises.

The bodies also highlighted that many companies own different spirit brands in the US, Canada and Mexico.

Houses

The US imports about a third of its softwood lumber from Canada each year, and that key building material could be hit by Trump’s tariffs.

Trump has said the US has “more lumber than we ever use”.

However, the National Association of Home Builders urged the president to exempt building materials “because of their harmful effect on housing affordability”.

The industry group has “serious concerns” that the tariffs on lumber could increase the cost of building homes – which are mostly made out of wood in the US – and also put off developers building new homes.

“Consumers end up paying for the tariffs in the form of higher home prices,” the NAHB said.

Imports from the rest of the world could also be affected.

On 1 March, Trump ordered an investigation into whether the US should place additional tariffs on most lumber and timber imports, regardless of their country of origin, or create incentives to boost domestic production.

Findings are due towards the end of 2025.

Maple syrup

Getty Images

Getty ImagesThe “most obvious” household impact of a trade war with Canada would be on the price of Canadian maple syrup, according to Thomas Sampson from the London School of Economics.

Canada’s billion-dollar industry accounts for 75% of the world’s entire maple syrup production.

The majority of the sweet staple – around 90% – is produced in the province of Quebec, where the world’s sole strategic reserve of maple syrup was set up 24 years ago.

“That maple syrup is going to become more expensive. And that’s a direct price increase that households will face,” Mr Sampson said.

“If I buy goods that are domestically produced in the US, but [which use] inputs from Canada, the price of those goods is also going to go up,” he added.

Fuel prices

Canada is America’s largest foreign supplier of crude oil.

According to the most recent official trade figures, 61% of oil imported into the US between January and November 2024 came from Canada.

While the US has introduced a 25% tariff on most goods imported from Canada, Canadian energy faces a lower rate of 10%.

The US doesn’t have a shortage of oil, but its refineries are designed to process so-called “heavier” – or thicker – crude oil, which mostly comes from Canada, with some from Mexico.

“Many refineries need heavier crude oil to maximize flexibility of gasoline, diesel and jet fuel production,” according to the American Fuel and Petrochemical Manufacturers.

That means if Canada decided to reduce crude oil exports in retaliation against US tariffs, it could push up fuel prices.

Avocados

Getty Images

Getty ImagesAvocados thrive in in the Mexican climate.

Nearly 90% of the avocados consumed in the US come from Mexico.

The US Agriculture Department has warned that tariffs on Mexican fruit and vegetables could increase the cost of avocados.

Related dishes like guacamole could also become more expensive.

Additional reporting by Lucy Acheson